Novavest Real Estate AG is convinced that incorporating sustainability criteria is a vital success factor in its business activities. This is particularly true as our aim is to generate lasting success and sustainable capital and revenue growth for our investors by investing in select residential and commercial properties throughout Switzerland.

As a responsible property investor, Novavest Real Estate AG manages its property portfolio with careful consideration of economic, environmental and social aspects. It pursues a holistic approach to sustainability in its activities relating to property development, renovation, conversion and management. It systematically considers the issue of sustainability in decisions along the value chain of the investment cycle. In doing so, Novavest Real Estate AG is making a contribution to achieving the Swiss Federal Government’s Energy Strategy for 2050.

Novavest Real Estate AG has set out its commitment to sustainability and defined a long-term sustainability strategy. The sustainability strategy sets objectives for minimising future risks and exploiting opportunities through both investments and the investment cycle. At the same time, Novavest Real Estate AG’s sustainability strategy meets its stakeholders’ current and future needs. Responsibility in the area of sustainability forms the basis for its activities and strategic development in the coming years.

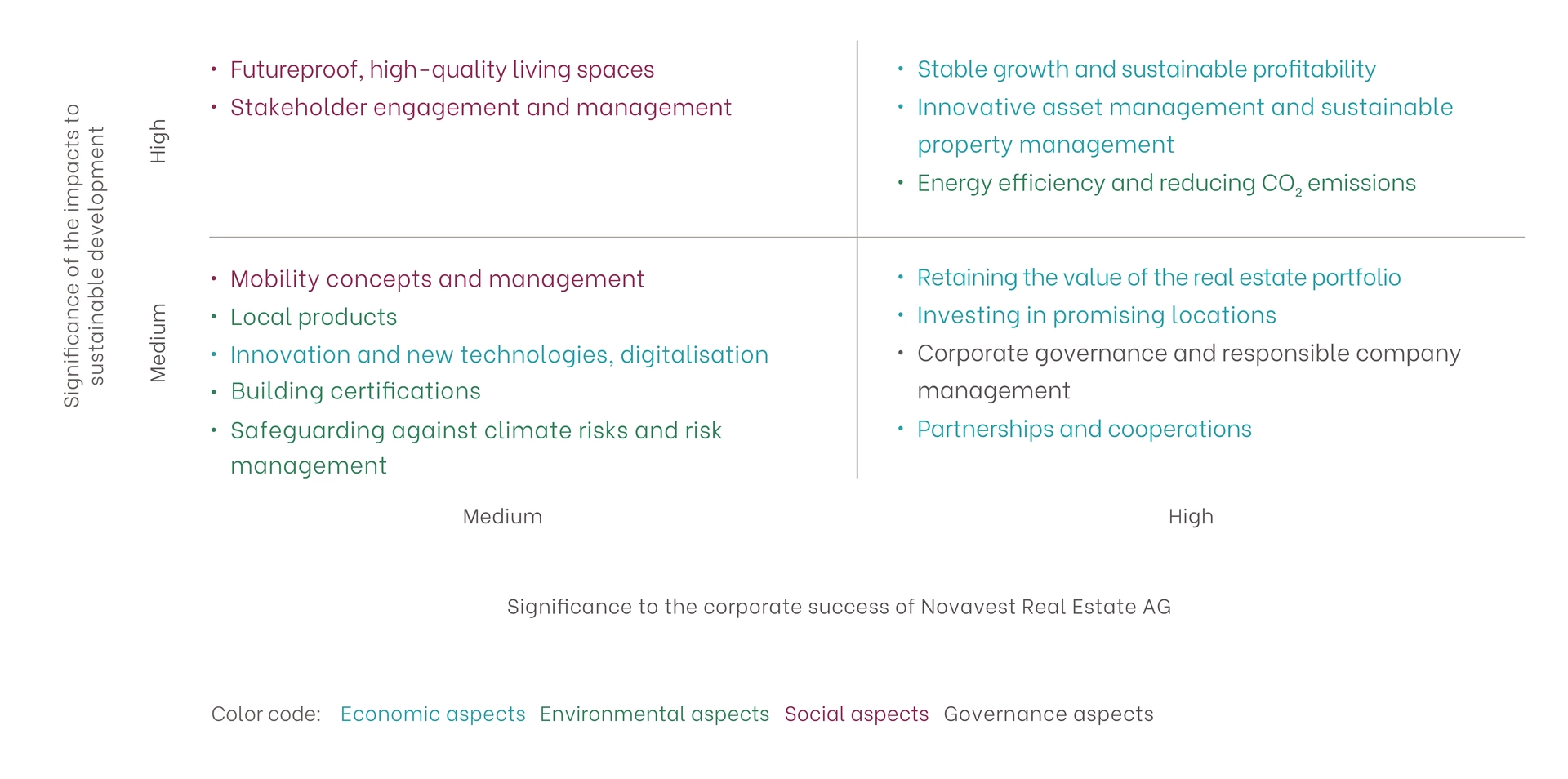

Objectives and material topics

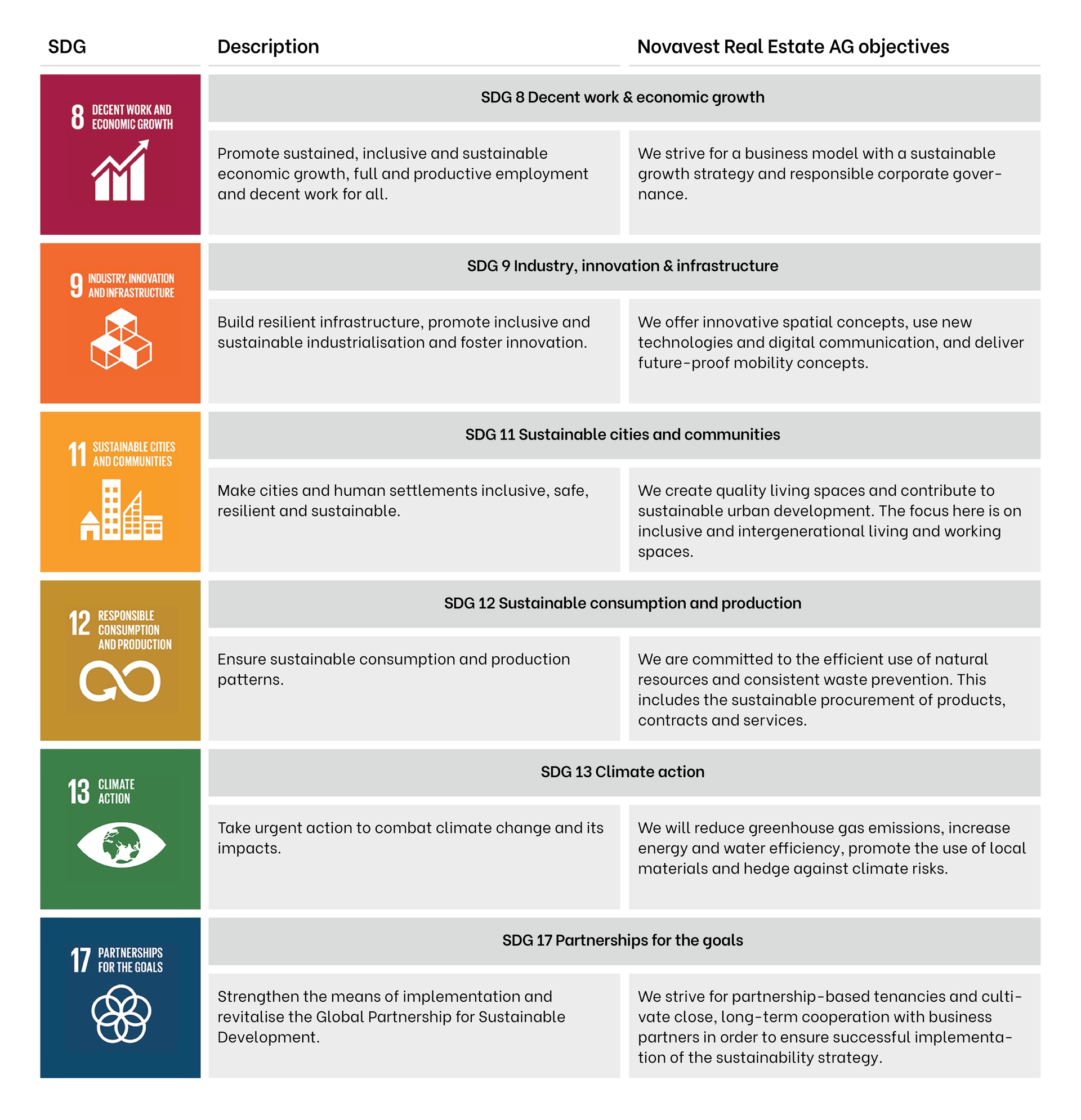

Novavest Real Estate AG adheres to the United Nations (UN) Sustainable Development Goals (SDG). The focus is on the following six SDGs, which Novavest Real Estate AG can contribute to achieving by fulfilling its responsibilities:

Environment

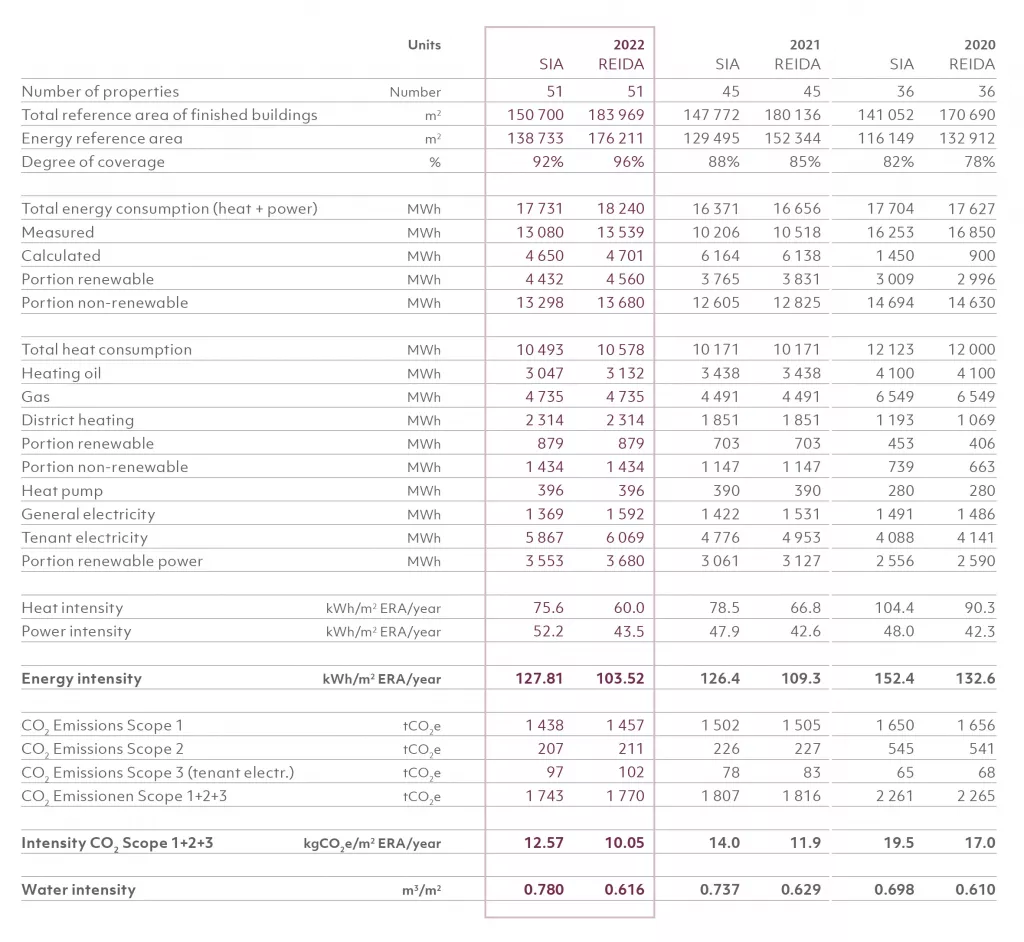

Novavest Real Estate AG is determined to reduce carbon emissions and support climate protection through active energy management.

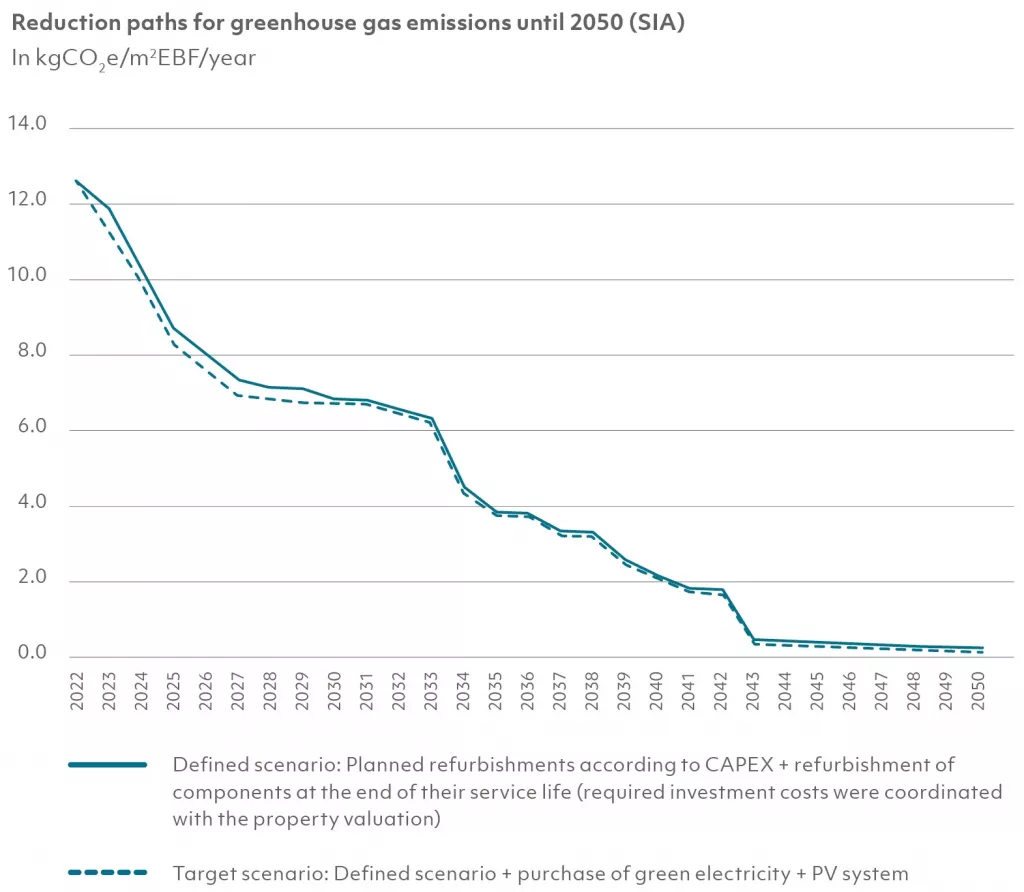

In financial year 2022, the existing 10-year investment plan was expanded for the first time to include a reduction path in scenarios. The measures required to implement the reduction path were refined in the 2023 financial year and the associated costs were analyzed as part of the 2023 end-of-year assessment.

The reduction path was redefined on this basis. In addition, sustainability criteria were added to the investment process in order to safeguard the quality of the portfolio in the long term and minimize the risk of stranded assets.

Stakeholders

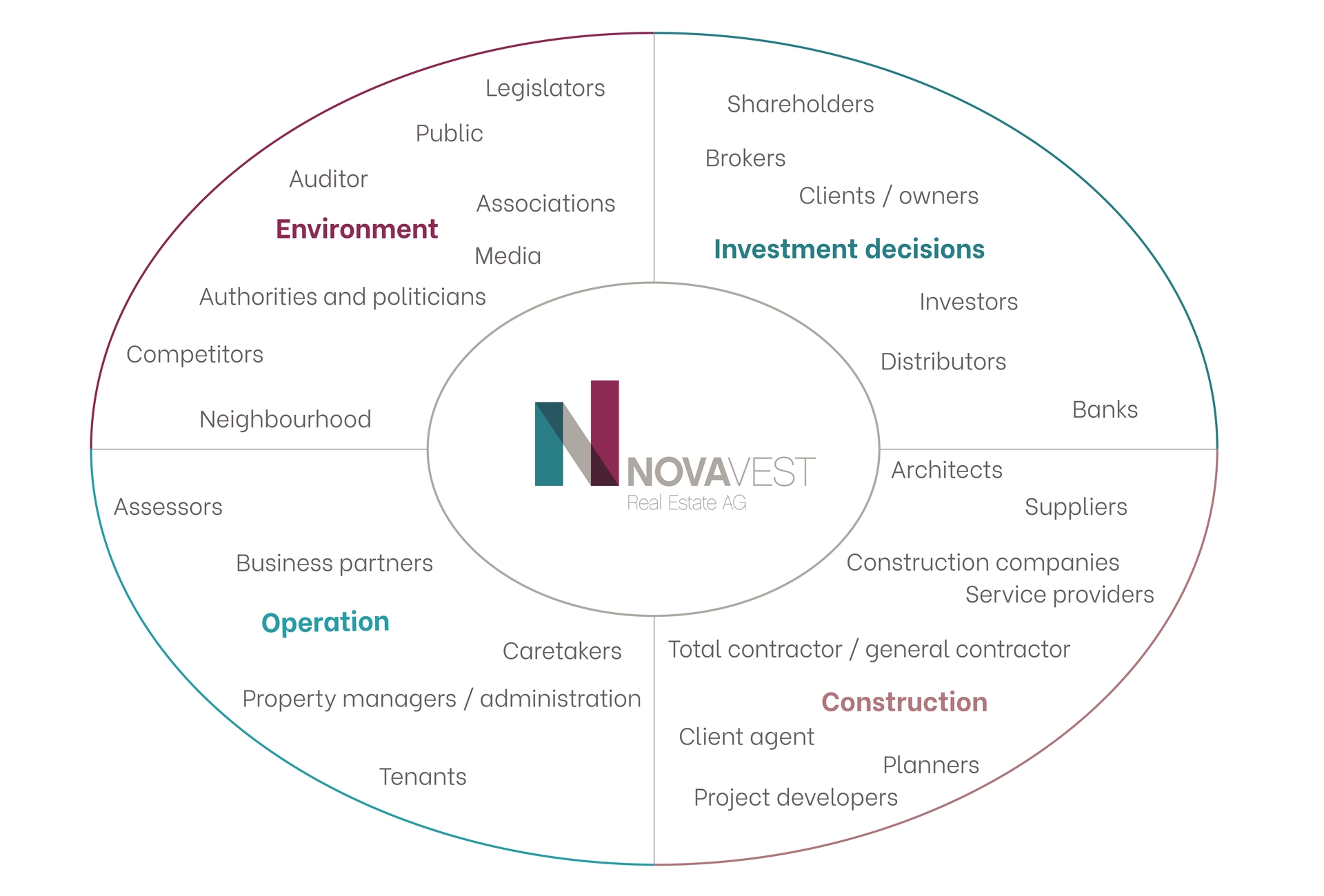

Novavest Real Estate AG is in contact with various stakeholder groups throughout its business activities. In doing so, we ensure a proactive, open and cooperative dialogue. Our stakeholders are important to us precisely because Novavest Real Estate AG can influence its stakeholders with its business activities and, at the same time, they can also contribute to the company’s long-term business success. The chart provides an overview of the key stakeholder groups.

Novavest Real Estate AG is committed to direct contact with its stakeholders and strives to maintain an appropriate relationship with its key stakeholders on an ongoing basis. Novavest Real Estate AG takes the demands of its stakeholders seriously and is committed to transparent and effective communication. Novavest Real Estate AG informs investors through press releases and reports (half-yearly and annual reports) as well as through annual general meetings and investor or analyst calls. The Executive Board is also available at any time to respond to questions. There is regular dialogue with the commercial tenants and the CEO also visits the main tenants at regular intervals, accompanied by the Asset Management team.

Novavest Real Estate AG has two employees. These are the members of the Executive Board (Chief Executive Officer, Chief Financial Officer). There are no other employees. This lean structure is possible because Novavest Real Estate AG receives comprehensive advice from Nova Property Fund Management AG, based in Pfäffikon (Canton Schwyz).

Nova Property Fund Management AG is an owner-managed Swiss fund management company audited by FINMA and has a comprehensive portfolio of property management services. Thanks to its extensive expertise, the Nova Property Fund Management AG team is broadly positioned and provides complex services in the areas of property management and administration, property development, portfolio expansion and adjustment, project development assistance, renovation, financial planning and financial management/controlling.

Further information

Corporate responsibility

Novavest Real Estate AG cultivates a responsible, value-oriented, people-oriented corporate and management culture. Novavest Real Estate AG’s ethical conduct is also in the interests of tenants, employees, business partners, the public and the investors whose interests we safeguard.

Novavest Real Estate AG’s corporate governance comprises internal rules and a code of conduct, management structures, processes and practices that promote fairness, transparency and accountability and ensure ethical and transparent corporate governance. There are regulations to prevent anti-competitive behaviour, money laundering and corruption.

Sustainability is integrated into the corporate strategy and is defined and regularly monitored by the Novavest Real Estate AG Board of Directors. The Board of Directors defines both the sustainability strategy and objectives. The Board of Directors is also responsible for making property investment decisions, taking into account of environmental issues. The operational implementation of the strategy and the development of the necessary property data is the Executive Board’s responsibility. It receives support from employees of Nova Property Fund Management AG, with whom the company has agreed a service contract, and from other external consultants. Together, they strive to achieve objectives in the sustainability strategy, identify opportunities for improvement and implement specific measures.

Novavest Real Estate AG has been a UN PRI (Principles for Responsible Investment) signatory since early March 2023. The aim is to commit to the six principles of responsible investment in the UN PRI.

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

Source: https://www.unpri.org/about-us/

Publications

Annual report and investor presentation

The current business report, featuring an integrated sustainability report, as well as the related conference call presentation, are available through the following link:

Certifications

Built in 2021, the apartment building in Zurich Altstetten received the DGNB gold certificate for Buildings in Use (GiB) in 2022:

In addition, a GEAK certificate (cantonal building energy certificate) was drawn up for about one quarter of Novavest Real Estate AG’s portfolio. Older properties were also supplemented with a GEAK Plus report. Information on the certifications can be found in the 2023 Annual Report: